Paye hourly rate calculator

If your desired annual salary is 50000 this is your calculation. - In case the pay rate is hourly.

26 000 After Tax 2021 Income Tax Uk

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

. Federal income tax rates range from 10 up to a top marginal rate of 37. 28 days holiday entitlement category A National Insurance rates and qualifying earnings pension contributions. See where that hard-earned money goes - with UK income tax National.

KiwiSaver Employer Contribution Year. A Hourly wage is the value. A salary or wage is the payment from an employer to a worker for the time and works contributed.

Yearly salary 52 weeks 375. Hours Health Leave Year. States dont impose their own income tax for.

If you get paid. To calculate annual salary to hourly wage we use this formula. The Hourly Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Hours Paid Year. Next divide this number from the.

By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. The results are broken down into yearly monthly weekly daily and hourly wages. See where that hard-earned money goes - Federal Income Tax Social Security.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. These figures are for illustrative purposes only and assumes. This number is based on 37 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid.

This federal hourly paycheck. 50000 37764 total overhead. If you get paid bi-weekly once every two weeks your gross paycheck will be 2308.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Hours Worked Year. How do I calculate hourly rate.

Median household income in 2020 was 67340. Hours Annual Leave Year. To protect workers many.

Related Take Home Pay Calculator Income Tax Calculator. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. Enter the Number of Hours.

The calculator has a drop-down menu that provides an option to enter either the hours worked per week or per month. To calculate your own ideal hourly rate divide your adjusted annual salary your desired annual salary your costs and expenses with your number of billable hours and then round up this figure to the nearest dollar. Enter the Hourly Wage Amount.

A yearly salary of 28000 is 1455 per hour.

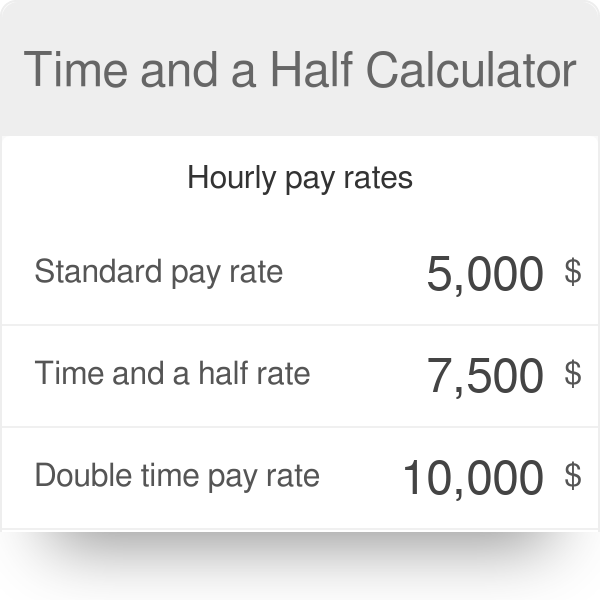

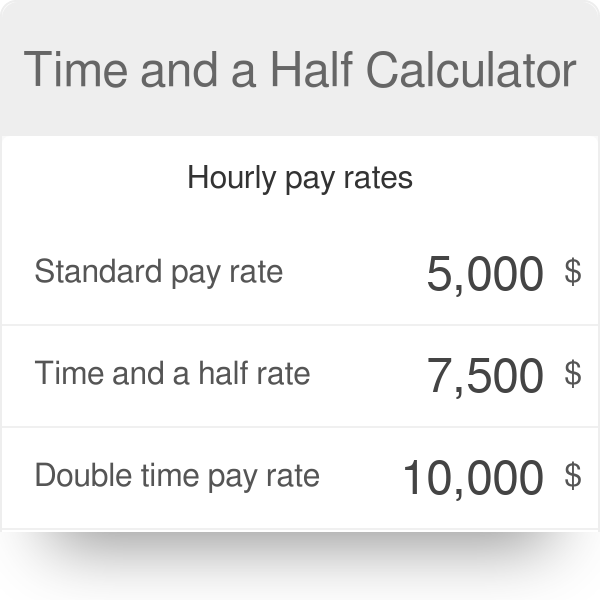

Time And A Half Calculator

Jamaica Monthly Salary Calculator 2022 Icalculator

Paye Calculator Paye Net Nz

Paye Tax Calculator Pro Amazon Com Appstore For Android

Salary Calculator Uk By Chris Ryan

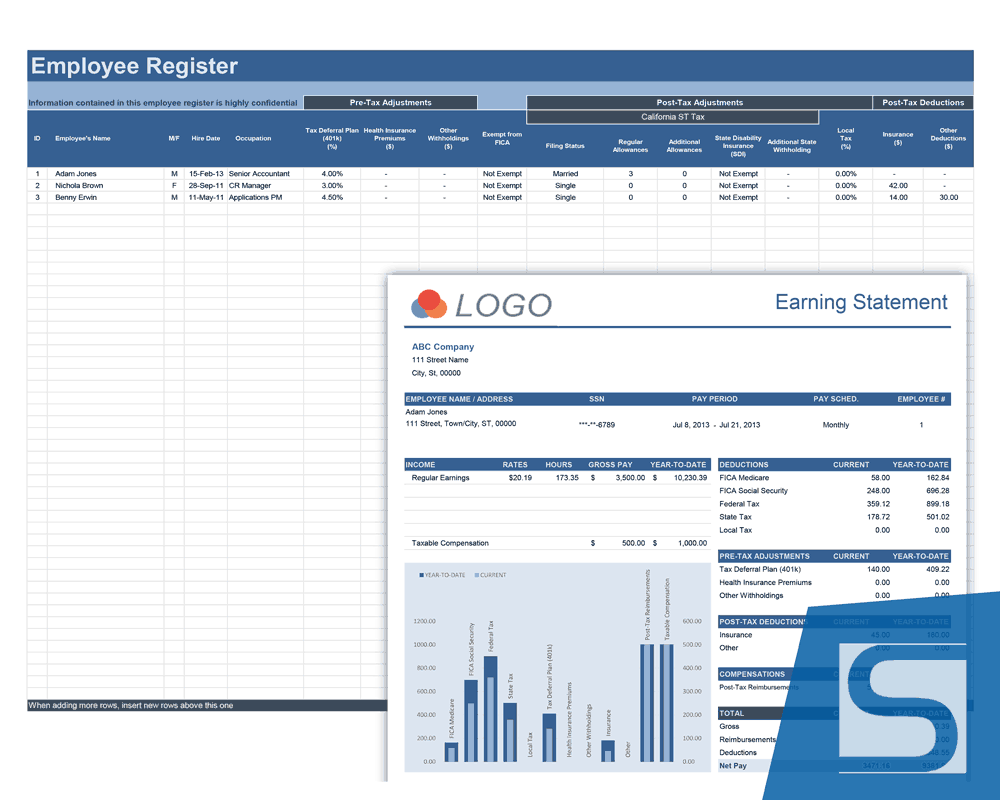

Payroll Calculator Free Employee Payroll Template For Excel

Paye Calculator Sonovate

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Pay Calculator

Salary Calculator Uk By Chris Ryan

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Payroll Calculator Free Employee Payroll Template For Excel

Paye Tax Calculator Pro Amazon Com Appstore For Android

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Subby To Salary Calculator Boss Tradie

How To Calculate Net Pay Step By Step Example